Alec Schmidt

Product Designer

Work

About

CV

Menu

Upstream KYC: Reducing Friction

Digit.co — January 2020

Digit expanded into regulated features like Bill Pay and Investing, but identity verification was blocking adoption with 31% of users abandoning during KYC. We moved verification upstream into everyday surfaces, reframing it as account maintenance instead of a barrier.

KYC Completion

62% → 76%

Feature Drop-off

31% → 18%

Time to Complete

12 days → 2 days

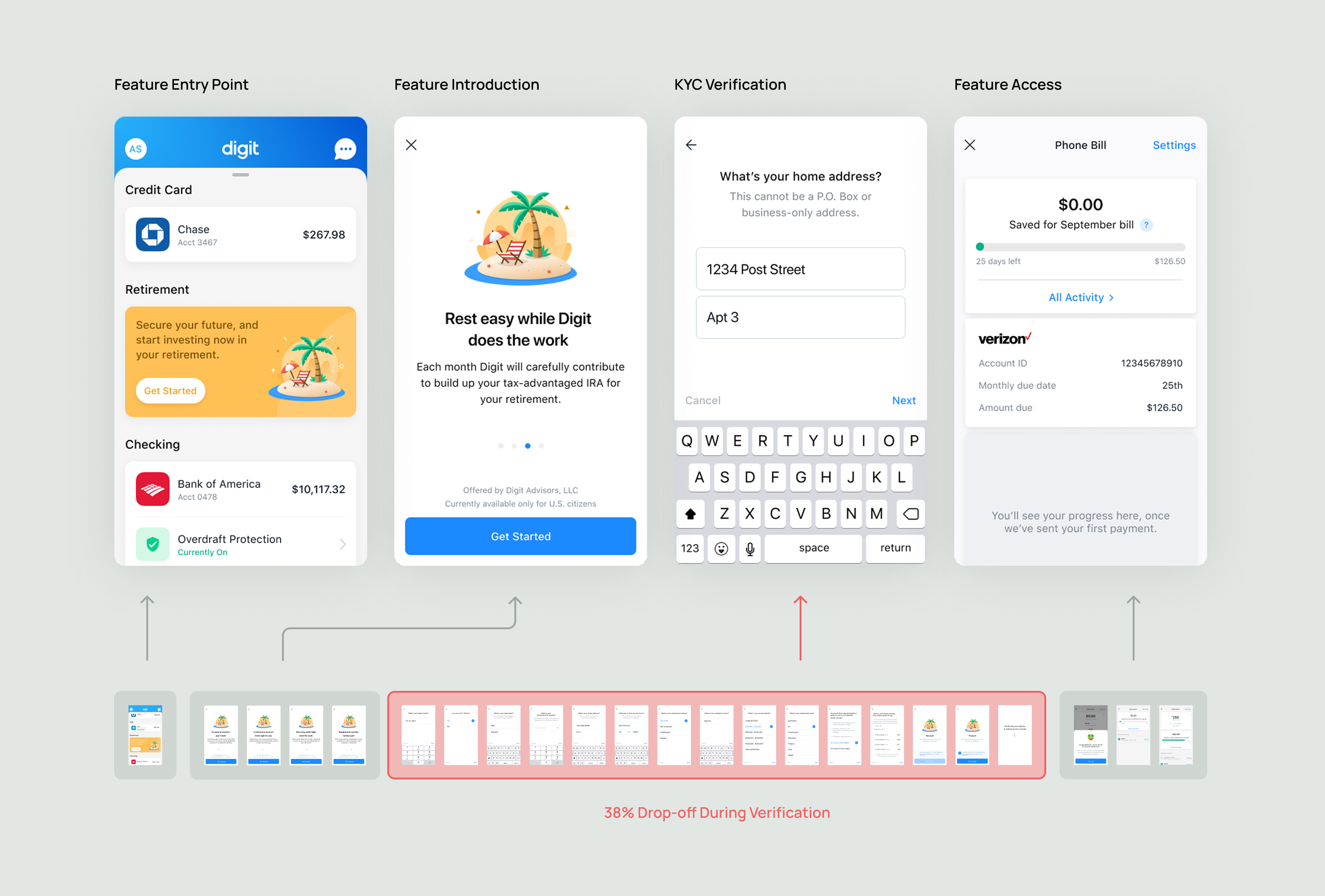

Problem Statement

Digit required KYC verification before users could access Bill Pay or Investing. The flow was appended to feature onboarding—tap "Start Investing," immediately hit a multi-step verification wall.

31% of users abandoned during KYC. Bill Pay adoption was 23% below target. The regulatory requirement couldn't change. But the timing was killing adoption.

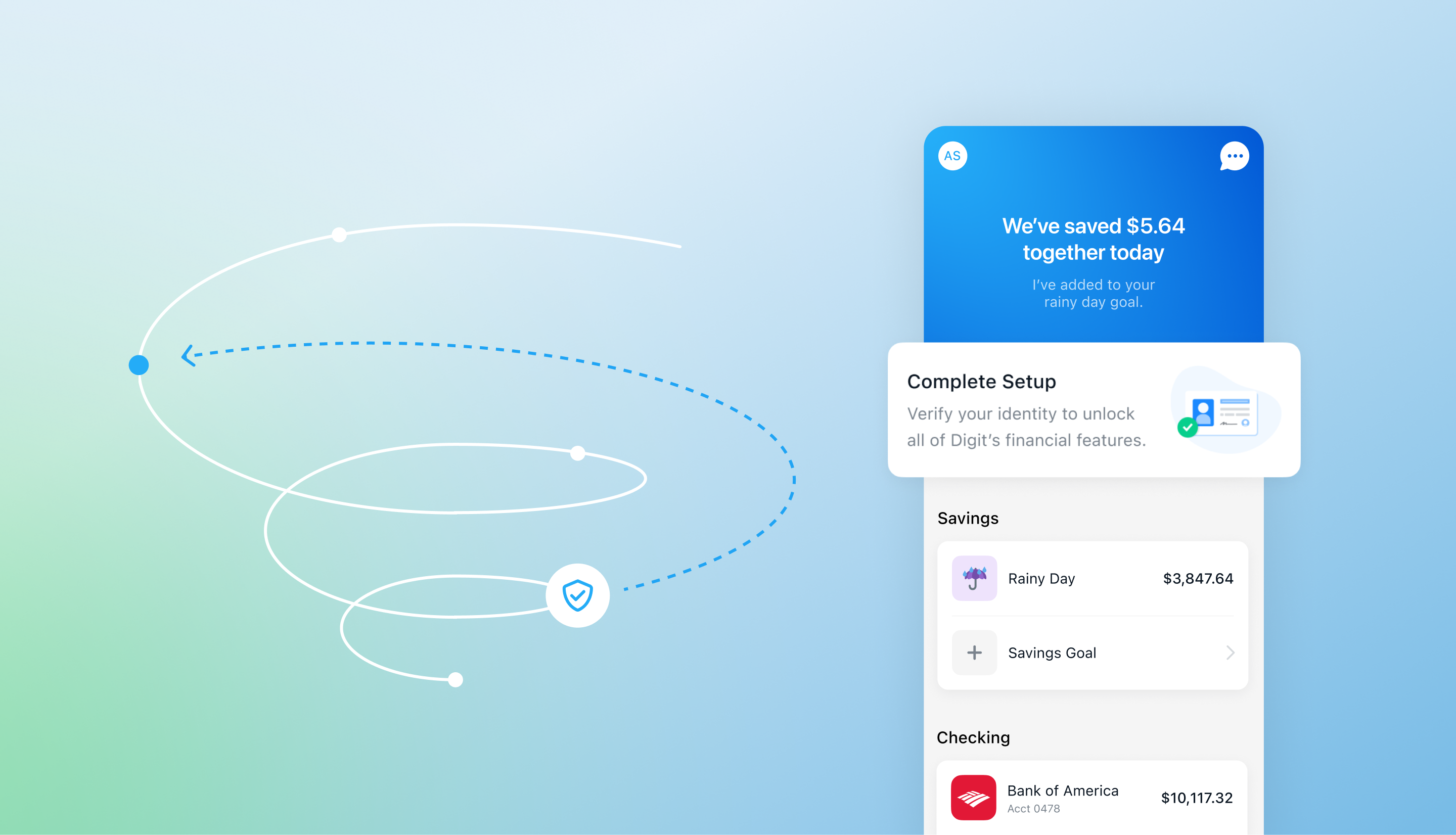

Insight

KYC abandonment wasn't about unwillingness to verify—it was about being blocked from something they just got excited about.

We hypothesized: surface KYC during routine check-ins, and it becomes proactive account maintenance instead of an unexpected obstacle.

Exploring the Entry Point

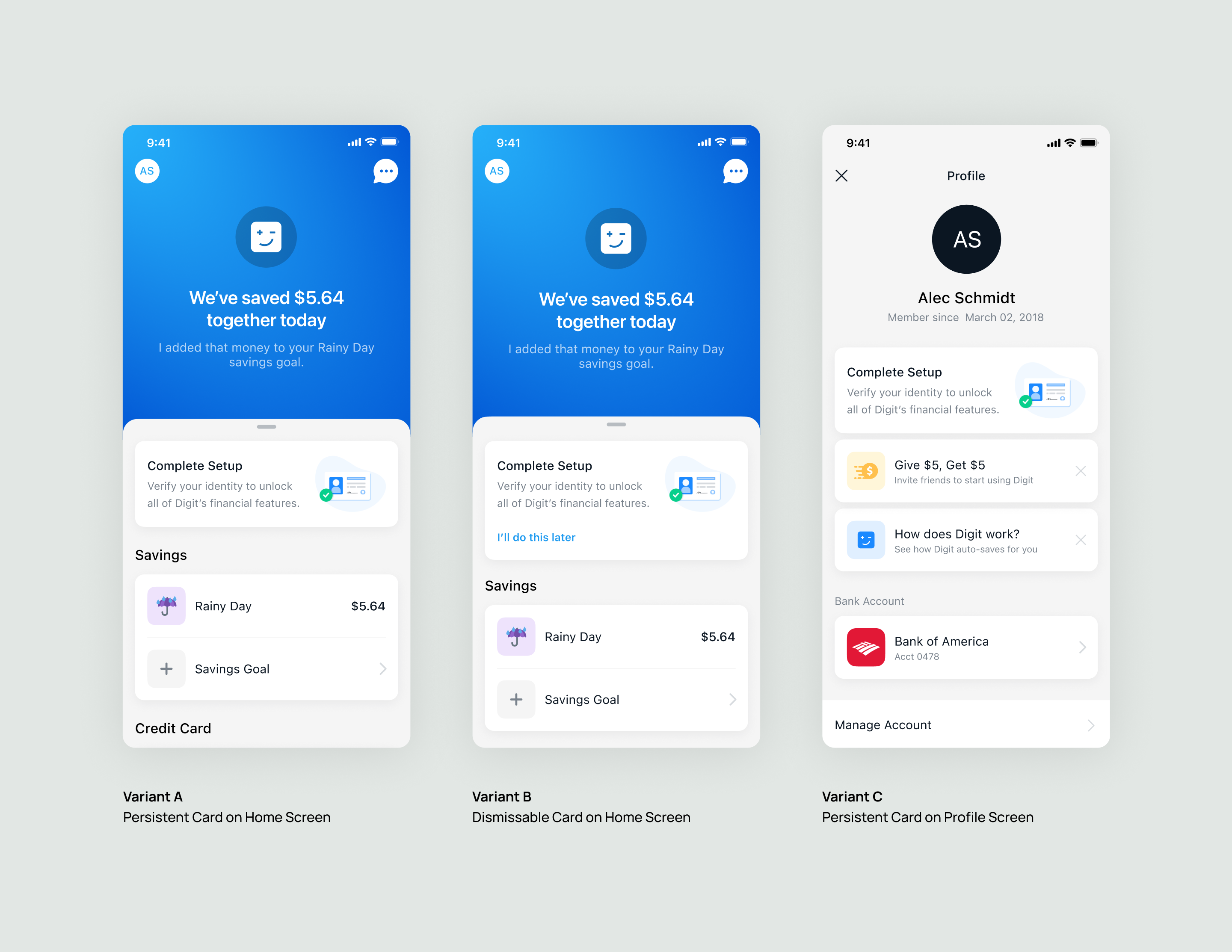

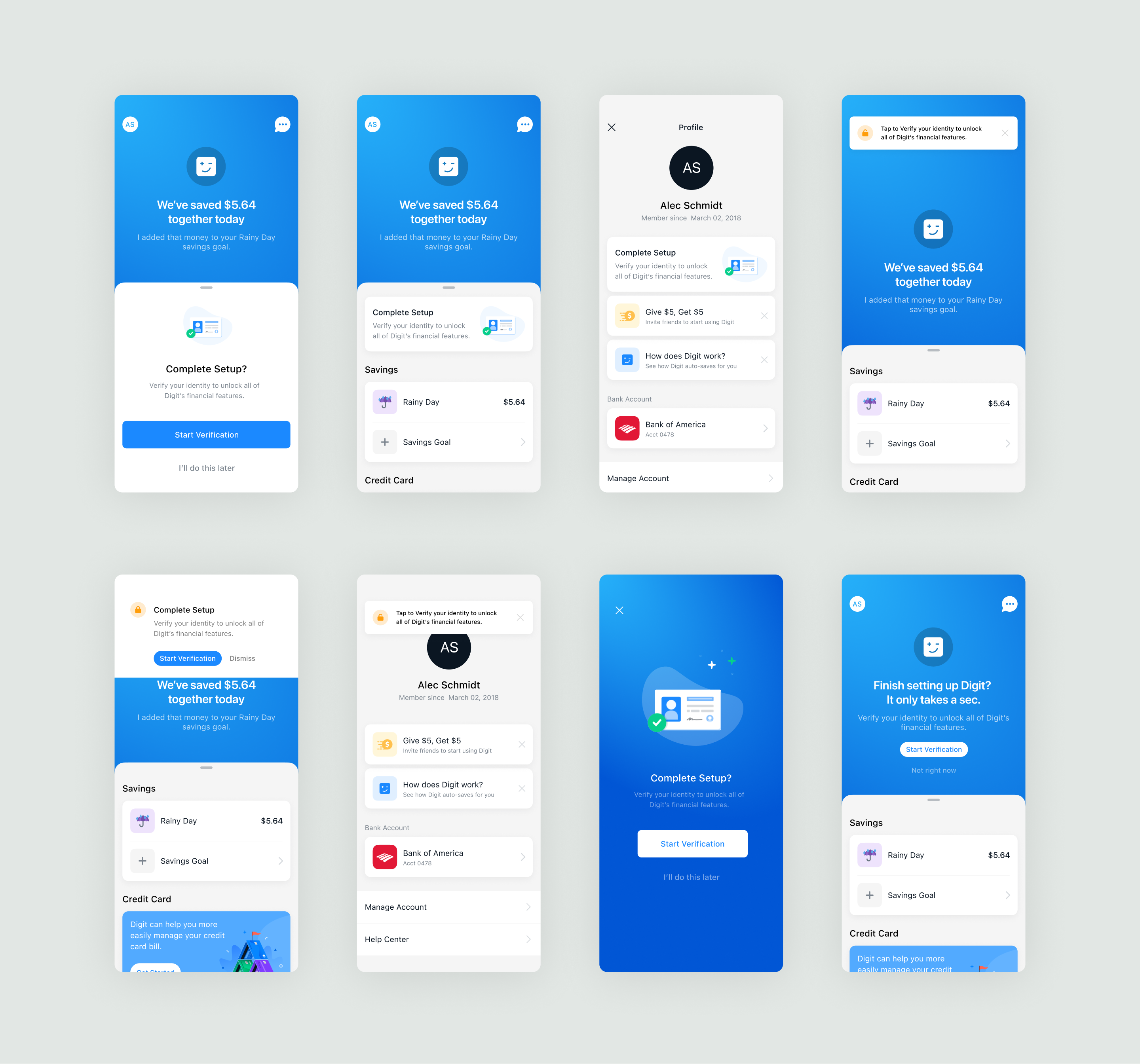

Once we decided to surface KYC elsewhere, I explored how prominent the prompt should be, from subtle inline links to full-width cards.

Solution

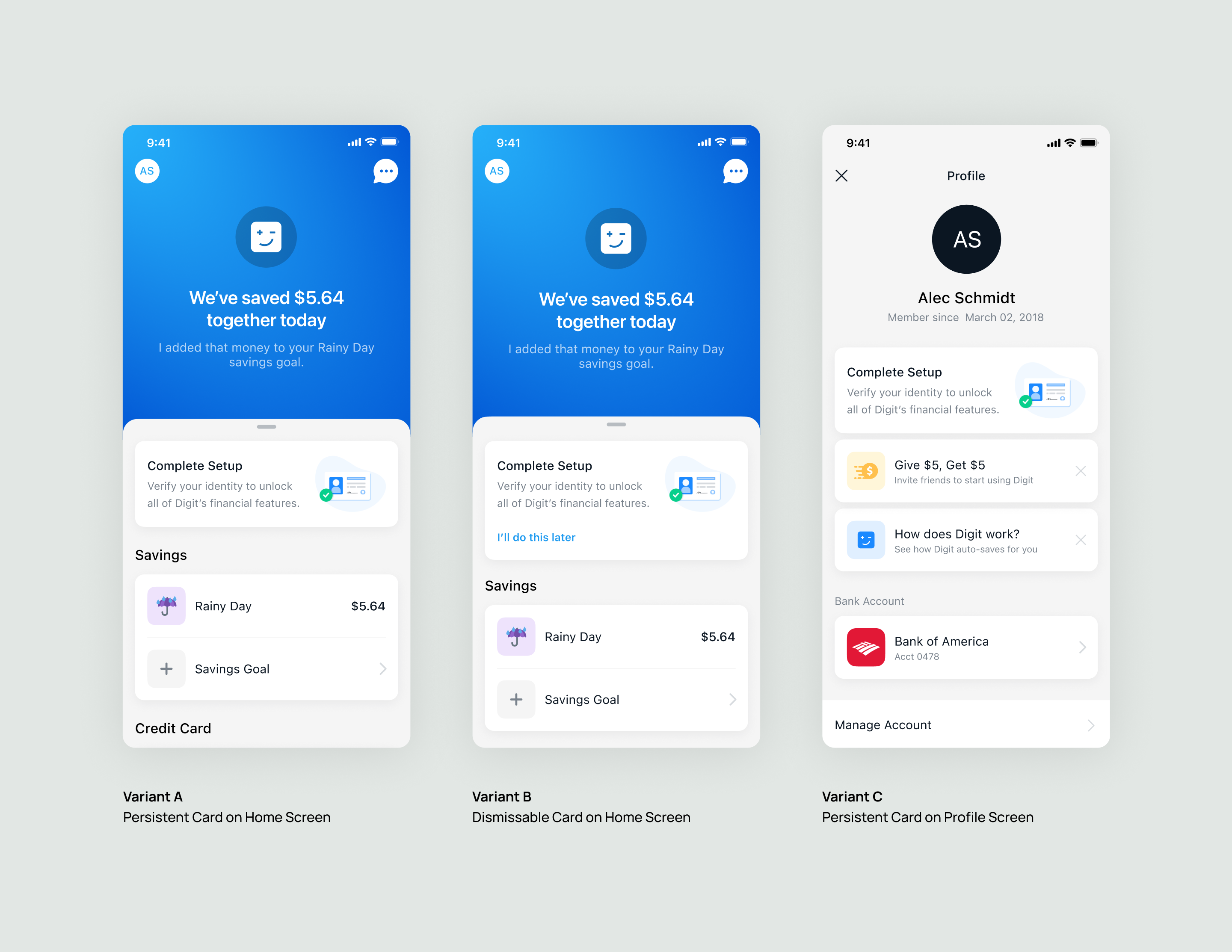

We tested three variants across two high-traffic surfaces: Home (checked daily) and Profile (account settings).

- Variant A: Persistent card on Home and Profile

- Variant B: Dismissible card on Home, fallback on Profile

- Variant C: Persistent card on Profile only

Results

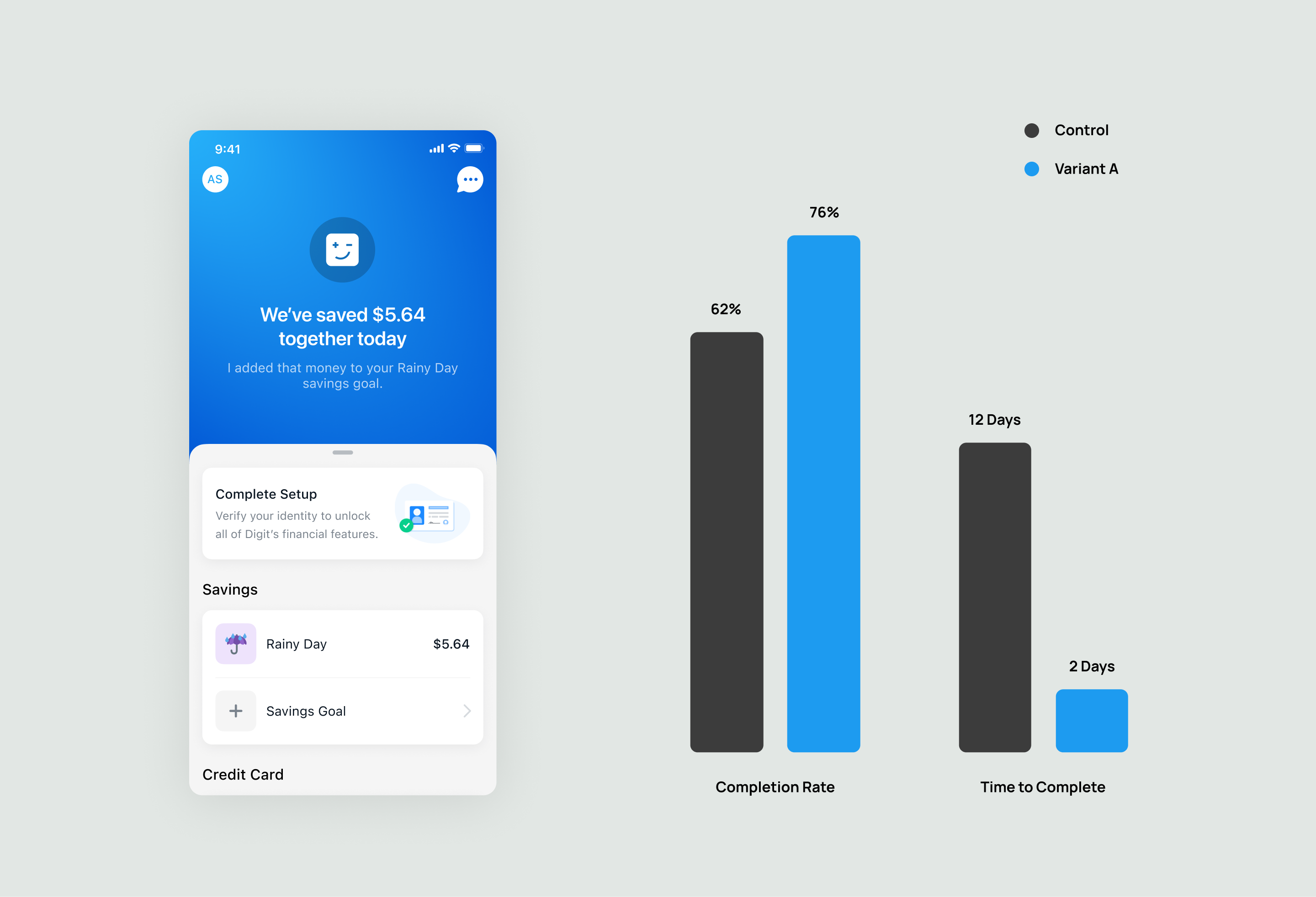

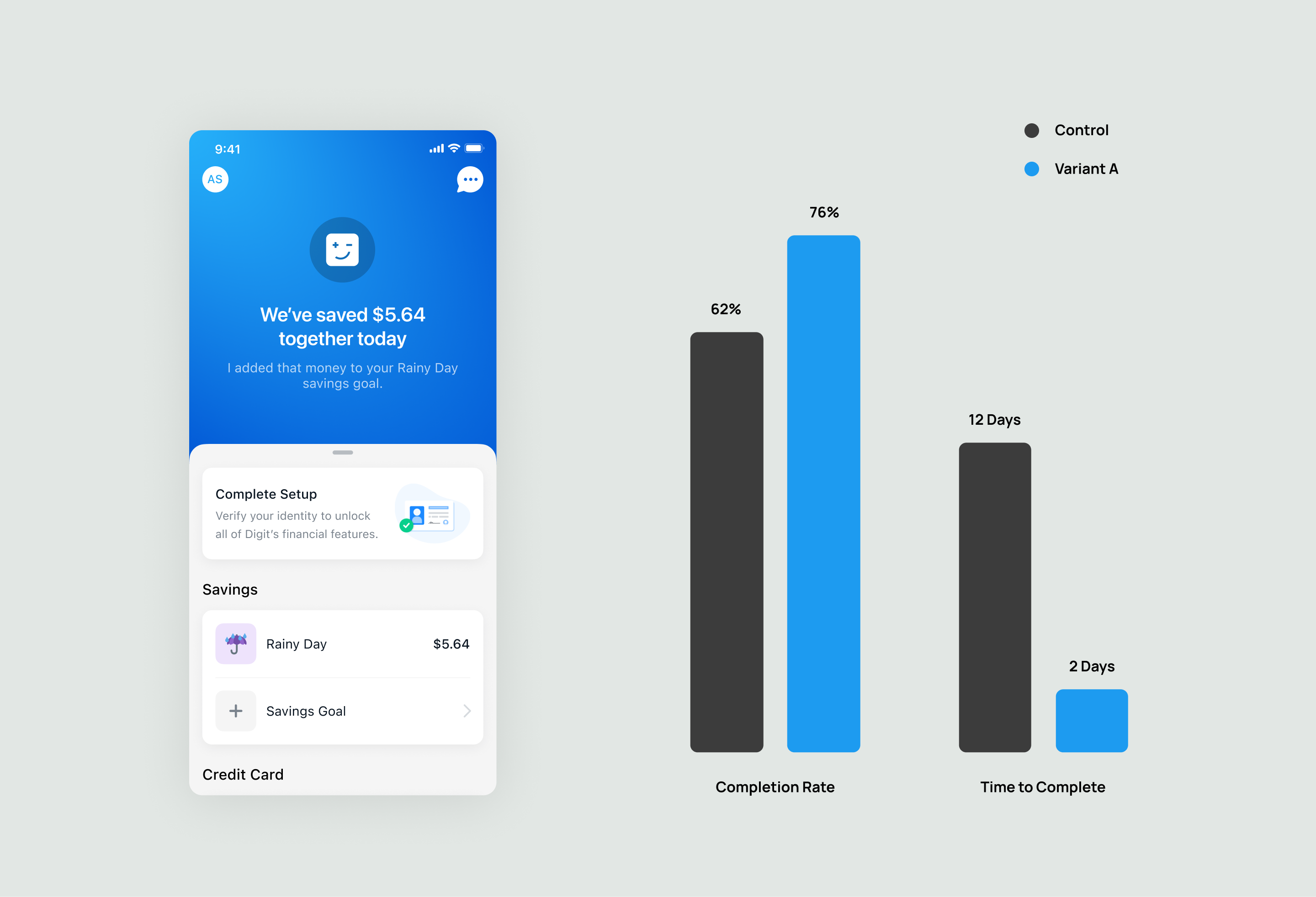

Variant A won decisively.

64% completed within 24 hours. Median time dropped from 12 days to 2.

The surprise: in Variant C, 71% of users who dismissed still completed within 7 days. Dismissal meant "not now," not "never."

Downstream Impact

Moving KYC upstream changed feature adoption:

- Bill Pay onboarding drop-off: -13%

- Time to first bill paid: 8.2 → 5.7 days

- Estimated additional investment volume: $640K over 6 months

What We Learned

Visibility wins, but context matters. Home worked because users were already in "financial check-in" mode—verification felt like responsible account maintenance.

Friction is about timing, not the task. The same verification flow converted 14% better when it wasn't blocking something users wanted.

Alec Schmidt

Product Designer

Work

About

CV

Menu

Upstream KYC: Reducing Friction

Digit.co — January 2020

Digit expanded into regulated features like Bill Pay and Investing, but identity verification was blocking adoption with 31% of users abandoning during KYC. We moved verification upstream into everyday surfaces, reframing it as account maintenance instead of a barrier.

KYC Completion

62% → 76%

Feature Drop-off

31% → 18%

Time to Complete

12 days → 2 days

Problem Statement

Digit required KYC verification before users could access Bill Pay or Investing. The flow was appended to feature onboarding—tap "Start Investing," immediately hit a multi-step verification wall.

31% of users abandoned during KYC. Bill Pay adoption was 23% below target. The regulatory requirement couldn't change. But the timing was killing adoption.

Insight

KYC abandonment wasn't about unwillingness to verify—it was about being blocked from something they just got excited about.

We hypothesized: surface KYC during routine check-ins, and it becomes proactive account maintenance instead of an unexpected obstacle.

Exploring the Entry Point

Once we decided to surface KYC elsewhere, I explored how prominent the prompt should be, from subtle inline links to full-width cards.

Solution

We tested three variants across two high-traffic surfaces: Home (checked daily) and Profile (account settings).

- Variant A: Persistent card on Home and Profile

- Variant B: Dismissible card on Home, fallback on Profile

- Variant C: Persistent card on Profile only

Results

Variant A won decisively.

64% completed within 24 hours. Median time dropped from 12 days to 2.

The surprise: in Variant C, 71% of users who dismissed still completed within 7 days. Dismissal meant "not now," not "never."

Metric

Completion Rate

Median Time to Complete

Support Volume

Control

62%

12 Days

Baseline

Variant A

76% (+14%)

2 Days

+0.8%

Variant B

71% (+9%)

4 Days

+0.5%

Variant C

65% (+3%)

10 Days

-0.2%

Downstream Impact

Moving KYC upstream changed feature adoption:

- Bill Pay onboarding drop-off: -13%

- Time to first bill paid: 8.2 → 5.7 days

- Estimated additional investment volume: $640K over 6 months

What We Learned

Visibility wins, but context matters. Home worked because users were already in "financial check-in" mode—verification felt like responsible account maintenance.

Friction is about timing, not the task. The same verification flow converted 14% better when it wasn't blocking something users wanted.

Upstream KYC: Reducing Friction

Digit.co — January 2020

Digit expanded into regulated features like Bill Pay and Investing, but identity verification was blocking adoption with 31% of users abandoning during KYC. We moved verification upstream into everyday surfaces, reframing it as account maintenance instead of a barrier.

KYC Completion

62% → 76%

Feature Drop-off

31% → 18%

Time to Complete

12 days → 2 days

Problem Statement

Digit required KYC verification before users could access Bill Pay or Investing. The flow was appended to feature onboarding—tap "Start Investing," immediately hit a multi-step verification wall.

31% of users abandoned during KYC. Bill Pay adoption was 23% below target. The regulatory requirement couldn't change. But the timing was killing adoption.

Insight

KYC abandonment wasn't about unwillingness to verify—it was about being blocked from something they just got excited about.

We hypothesized: surface KYC during routine check-ins, and it becomes proactive account maintenance instead of an unexpected obstacle.

Exploring the Entry Point

Once we decided to surface KYC elsewhere, I explored how prominent the prompt should be, from subtle inline links to full-width cards.

Solution

We tested three variants across two high-traffic surfaces: Home (checked daily) and Profile (account settings).

- Variant A: Persistent card on Home and Profile

- Variant B: Dismissible card on Home, fallback on Profile

- Variant C: Persistent card on Profile only

Results

Variant A won decisively.

64% completed within 24 hours. Median time dropped from 12 days to 2.

The surprise: in Variant C, 71% of users who dismissed still completed within 7 days. Dismissal meant "not now," not "never."

Metric

Completion Rate

Median Time to Complete

Support Volume

Control

62%

12 Days

Baseline

Variant A

76% (+14%)

2 Days

+0.8%

Variant B

71% (+9%)

4 Days

+0.5%

Variant C

65% (+3%)

10 Days

-0.2%

Downstream Impact

Moving KYC upstream changed feature adoption:

- Bill Pay onboarding drop-off: -13%

- Time to first bill paid: 8.2 → 5.7 days

- Estimated additional investment volume: $640K over 6 months

What We Learned

Visibility wins, but context matters. Home worked because users were already in "financial check-in" mode—verification felt like responsible account maintenance.

Friction is about timing, not the task. The same verification flow converted 14% better when it wasn't blocking something users wanted.